There was good news for those saving for retirement in the recent appropriations bill passed to fund the government, signed into law by President Biden on December 29, 2022. The larger bill included a set of retirement reforms called SECURE 2.0. A kind of sequel to the SECURE Act passed by the Trump Administration in 2019, SECURE 2.0 makes it easier to save for retirement, more manageable to preserve savings in retirement, and more accessible for businesses to provide retirement benefits.

While there was regular debate about individual provisions, SECURE and SECURE 2.0 were jointly sponsored by Democrats and Republicans and had broad bipartisan support.

We do not expect the new law to directly impact markets, but it will likely impact how people save for retirement and how businesses provide retirement benefits. Here are highlights of some of the more important provisions in the bill. Note that this is just a high-level overview, and many provisions go into effect at various times over the next few years or may have specific requirements or limits.

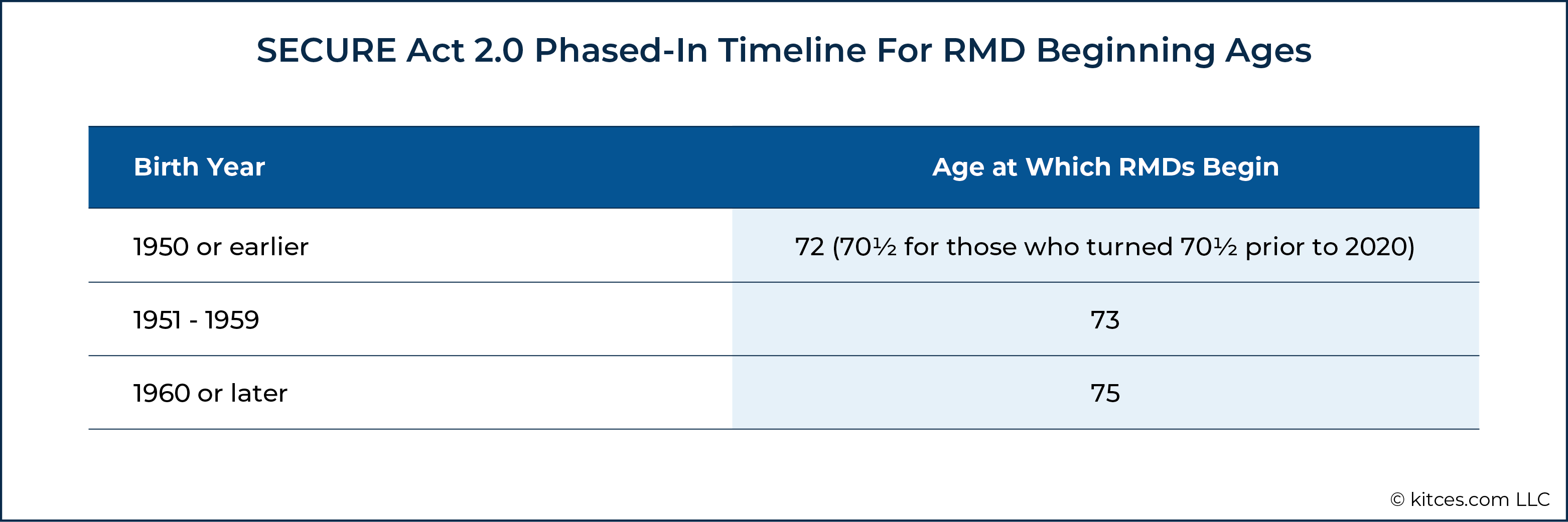

- SECURE 2.0 raised the age at which retirement plan minimum distributions must begin from 72 to 73, effective in 2023, and eventually to 75 (in 2033), allowing retirement plan participants who do not need distributions immediately to have a more extended period to potentially accumulate tax-deferred gains. While the direct wording regarding age of RMDs might leave some people scratching their heads to understand it, the easiest way is by looking at your birth year and using our table below.

- For those generally younger workers who may be missing out on employer matching funds because they need to prioritize student loan payments over saving, employers may now make matching retirement contributions based on student loan payments.

- Catch-up contribution limits for those near retirement have been increased.

- Steep penalties for missing required minimum distributions, often a result of oversight rather than an intention to abuse the law, have been decreased, especially in cases where the mistake is redressed quickly. Self-correction of inadvertent mistakes also won’t require submission to the IRS.

- The law also establishes a national database of retirement accounts so that no one has to worry about forgetting about an old account, which is already a problem and is likely to increase as people switch jobs more often.

- The law allows emergency savings accounts within a 401(k) that will allow limited withdrawals of up to $1,000 without penalty.

- Certain unused assets in 529 plans, a tax-advantaged plan used to pay for educational expenses, will now be allowed to be rolled over into a Roth IRA.

- New plans will have auto-enrollment and automatic increases over time. However, there is no requirement to start a plan.

- The law has several provisions that make it easier for businesses to provide retirement benefits, including enhancing tax credits for small businesses starting and maintaining a retirement plan.

- Opportunities to save on a Roth basis in several types of retirement accounts have been expanded.

Making it easier to save for retirement is a solid win. The law adequately addresses the challenges faced by those at different stages of saving for retirement and those already in retirement.

Please consult one of our advisors to understand how SECURE 2.0 might affect you and how you can take advantage of the new provisions.