Many of you may know of people trying to purchase a house and have heard of some horror stories of prices going above ask and stiff competition for each home on the market! Owning a home has always been a cornerstone of the American Dream. However, since January of 2021, achieving this dream has become increasingly difficult for many.

Housing affordability has reached new lows, leaving potential homebuyers grappling with the realities of a challenging market. The U.S. Fixed Housing Affordability Index assesses housing affordability for the average American household. It considers various factors such as median household income, mortgage interest rates, and housing prices. The index indicates the percentage of income needed to cover mortgage payments on a typical home. A higher index value suggests greater affordability, while a lower value indicates increased difficulty in affording housing. Policymakers, economists, and prospective homebuyers rely on this index to gauge the state of the housing market and make informed decisions regarding housing affordability.

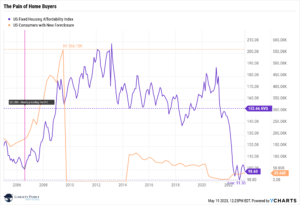

In the chart below, the purple line represents the index described above. The pink line shows a point that directly preceded the Global Financial Crisis while the yellow line is examining new home foreclosures.

The numbers paint a grim picture for current buyers. Soaring housing prices have emerged as a primary culprit, exerting immense pressure on prospective buyers. While home prices have skyrocketed, incomes and portfolio returns have yet to keep pace. Further adding to the pain is the rapid increase in mortgage rates resulting from the Feds combating inflation. Consequently, the gap between what individuals can afford and the cost of homes has widened considerably.

Luckily, it’s not all doom and gloom, as sales of previously owned homes fell in April from the prior month, and prices declined from a year earlier by the most in more than 11 years. Furthermore, as many economists and market predictors expect rate cuts in 2024, the price drop combined with lower mortgage rates should help the index return to its average, hopefully alleviating the elevated stress and pressure on current home buyers!

P.S. – some may infer from the previous chart that home foreclosures may be on the rise; however, this likely won’t be the case as since 2020, we’ve seen home values rise a whopping 37%, which means many homeowners are likely sitting on a nice amount of equity which can help fend off foreclosures.